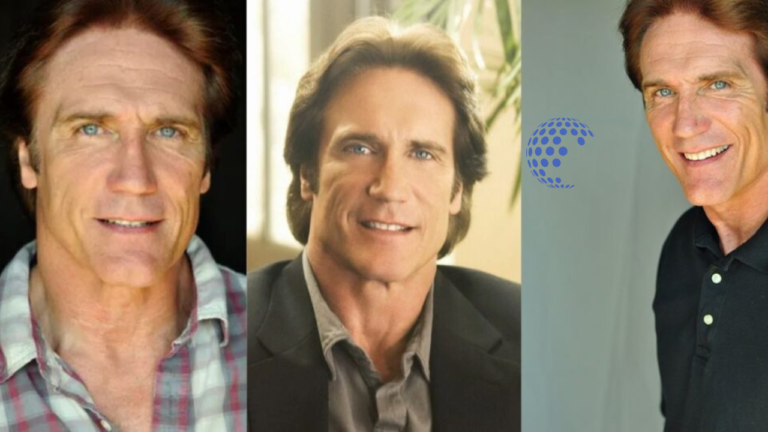

CEO of White Oak: Unveiling Andre Hakkak’s net worth

Andre Hakkak’s net worth remains a topic of speculation among industry insiders and finance enthusiasts. As the co-founder and CEO of White Oak Global Advisors, Hakkak has significantly impacted the alternative asset management sector. With his extensive experience and leadership skills, it is no surprise that his net worth is believed to be substantial. In this blog post, we will delve into Hakkak’s journey to financial success and the growth of White Oak under his guidance and analyze the factors contributing to his wealth.

The Journey of Andre Hakkak to Financial Eminence

Andre Hakkak’s ascent in the financial world is marked by his remarkable entrepreneurial flair and a profound understanding of market dynamics. Before embarking on the venture that would become White Oak Global Advisors, Hakkak immersed himself in the finance sector, accumulating a wealth of knowledge and expertise that would later serve as the cornerstone of his success. His career is distinguished by periods of intensive learning and strategic decision-making, setting the stage for his future endeavours.

Hakkak’s professional background is characterized by his roles at several prestigious financial institutions, where he cultivated a deep expertise in investment strategies, risk management, and capital allocation. These experiences equipped him with the unique skill set necessary to navigate the complexities of the global finance landscape, enabling him to identify and capitalize on investment opportunities that others might overlook.

Hakkak’s unwavering commitment to innovation and his forward-thinking approach to investment sets him apart. His ability to foresee market trends and adapt to changing economic environments has been crucial in his journey. This adaptability and entrepreneurial spirit propelled him to co-found White Oak, setting the foundation for a significant chapter in his career.

Throughout this period of professional growth, Hakkak developed a reputation for his astute investment judgment and capability to manage and mitigate risks effectively. These traits have been instrumental in his rise to financial eminence and laid the groundwork for the success of White Oak Global Advisors. By leveraging his comprehensive understanding of the finance industry and his strategic insights, Hakkak has navigated the firm to its current stature in the alternative asset management sector, solidifying his legacy as a visionary in the field.

White Oak Global Advisors: A Testament to Innovative Investment

Under Andre Hakkak’s astute leadership, White Oak Global Advisors has emerged as a beacon of innovation in alternative asset management. This firm distinguishes itself through its commitment to pioneering investment strategies prioritizing long-term client value. With a portfolio that encompasses billions in assets, White Oak’s trajectory mirrors Hakkak’s visionary approach and deep industry insights. The firm’s success is deeply rooted in its ability to craft unique solutions tailored to the complex needs of its investors, thereby setting new benchmarks in the sector.

The ethos of White Oak revolves around a keen emphasis on flexibility, risk management, and responsiveness to market changes, which reflect Hakkak’s personal investment philosophy. By fostering a culture of agility and critical thinking, the firm can navigate the volatile landscapes of global markets. This strategic positioning allows White Oak to leverage opportunities aligned with its rigorous investment criteria, ensuring robust returns and safeguarding investor capital.

Integrating advanced analytics and comprehensive due diligence processes is central to White Oak’s operational model. This analytical framework enhances the firm’s ability to identify undervalued assets and sectors with high growth potential, a testament to the innovative spirit Hakkak has instilled within the organization. Furthermore, White Oak’s commitment to ethical investing and transparency has cemented its reputation among clients and peers, underscoring its role as a trailblazer in the alternative asset management industry.

In forging partnerships and expanding its global footprint, White Oak Global Advisors leverages its expertise to explore new horizons and investment territories. The firm’s proactive approach to seeking non-traditional investment avenues exemplifies its dedication to staying at the forefront of financial innovation. This strategy amplifies White Oak’s influence in the market and reinforces its capacity to generate significant value for stakeholders, echoing Andre Hakkak’s enduring impact on investment management.

Decoding Andre Hakkak’s Net Worth: An Analysis

Piecing together Andre Hakkak’s net worth involves examining the tangible impact of his strategic leadership at White Oak Global Advisors. His financial acumen has been pivotal in guiding the firm’s ascent within the alternative asset management industry. Under his stewardship, the firm has achieved noteworthy milestones, managing billions in assets and pioneering innovative investment strategies that significantly influence its market position. This success, inherently linked to Hakkak’s decision-making and market insight, gives us a glimpse into the potential scale of his wealth.

The realm of alternative asset management is known for its lucrative returns, and White Oak’s prosperous trajectory suggests that Hakkak has effectively leveraged this aspect to his advantage. His proficiency in identifying and capitalizing on investment opportunities presents him as a key beneficiary of the firm’s profitable endeavours. His role in securing and expanding high-value investments, critical components of wealth generation in this sector, underscores the relationship between the company’s prosperity and Hakkak’s net worth.

Further, Hakkak’s ability to navigate the firm through fluctuating market conditions, ensuring sustained growth and stability, hints at a sophisticated understanding of wealth management. This skill set augments the firm’s financial health and reflects on Hakkak’s economic strategies, likely mirroring his professional success with personal wealth accumulation. While the absence of explicit figures shrouds his net worth in mystery, the confluence of his leadership qualities, the firm’s achievements, and the nature of the industry suggest a substantial personal financial status.

Leadership and Wealth: Hakkak’s Influence on White Oak’s Success

At the helm of White Oak Global Advisors, Andre Hakkak has been a central figure in steering the company toward its current esteemed position in the competitive landscape of alternative asset management. His leadership is characterized by a unique blend of strategic foresight and a keen understanding of the complexities of the financial markets. Hakkak’s approach to leadership goes beyond mere management; he fosters a culture of innovation, encouraging his team to pursue unconventional investment strategies that have set White Oak apart from its peers.

Hakkak’s influence on White Oak’s success is evident in its robust portfolio and ability to consistently deliver value to its clients, even in tumultuous market conditions. His knack for recognizing emerging trends and positioning the firm to capitalize on these opportunities has been a hallmark of his tenure. This reflects his wealth-creation prowess and showcases his capacity to engender growth and stability within the firm.

Under Hakkak’s guidance, White Oak has expanded its asset base and diversified its investment offerings, catering to a broad spectrum of clients. This strategic diversification has fortified the firm’s market presence, making it a formidable entity in alternative investments. Hakkak’s leadership has instilled a sense of resilience and adaptability in White Oak, enabling it to navigate the ebbs and flows of the global financial landscape with grace and agility.

His leadership ethos, which emphasizes ethical practices and transparency, has also contributed to forging lasting relationships with investors and stakeholders, further cementing the firm’s reputation and success. As Hakkak continues to lead White Oak with his visionary outlook, his impact on the firm’s trajectory remains profound, reflecting its financial success and reputable standing in the industry.

Read More

The Future of White Oak and Andre Hakkak’s Financial Trajectory

The horizon looks promising for White Oak Global Advisors, with its trajectory of innovation and growth showing no signs of abating. Steering this journey is Andre Hakkak, whose financial savviness and leadership prowess have been instrumental in the firm’s accomplishments. As the landscape of alternative asset management continues to evolve, Hakkak’s ability to adapt and lead with foresight positions him and White Oak for continued prosperity.

His knack for identifying untapped markets and leveraging emerging opportunities suggests that his wealth and the firm’s assets under management will likely see significant increments. With an unwavering commitment to ethical investment practices and a keen eye on global market trends, Hakkak is set to enhance White Oak’s footprint further, exploring new avenues for investment that promise high returns. The firm’s robust risk assessment framework and agility in response to economic fluctuations underscore its readiness for future challenges and opportunities.

As Hakkak charts the course for White Oak, his financial landscape is poised for growth parallel to the firm’s trajectory. His strategic approach to wealth management, mirroring his professional methodology, is expected to bolster his standing as a finance magnate. With a solid track record and a clear vision for the future, Andre Hakkak and White Oak Global Advisors are on a path to redefine the contours of alternative investment, promising a journey marked by innovation, growth, and financial success.